Introduction to Equitable Property Value

Equitable Property Value can be used to share authoritative property information, educate taxpayers and collect feedback from taxpayers when they are concerned about the equity of their property value.

It provides 24/7 access to answer common property and tax distribution questions in order to increase public trust and streamline the assessment appeals process. This approach helps stakeholders make well-informed property and development decisions. Equitable Property Value is typically implemented by property appraisal departments, assessors, fiscal offices, and other local government organizations that want to engage taxpayers in the property valuation process.

The Equitable Property Value solution delivers a set of capabilities that help you communicate parcel, property sales, and floodplain information as well as solicit assessment appeals from property owners in order to improve customer service and promote fair and equitable property values.

Learn more about the Equitable Property Value solution.

Equitable Property Value requires the following:

- ArcGIS Online

- ArcGIS Hub Premium

- Survey123 Connect

Information products

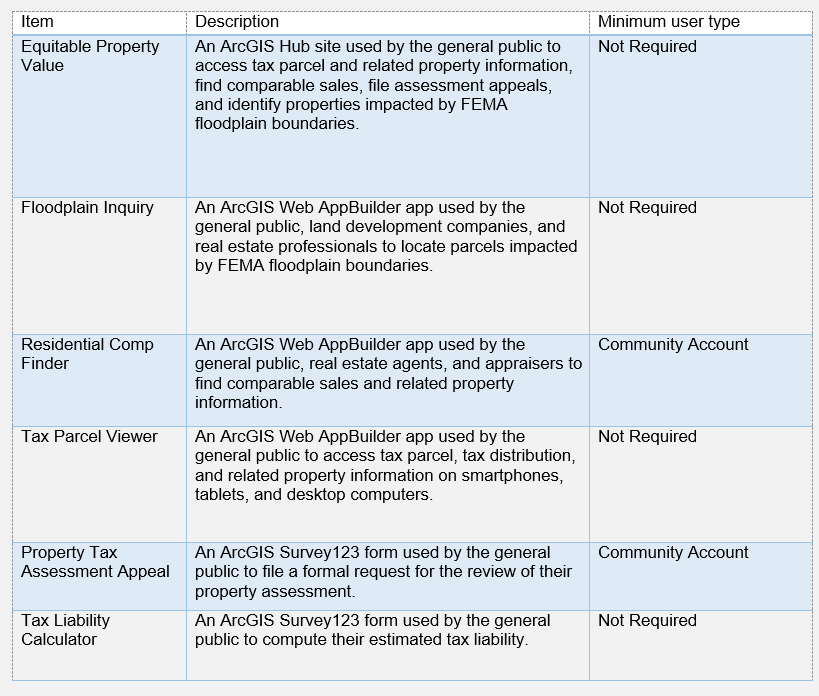

Equitable Property Value includes the following information products:

When you deploy this solution in your ArcGIS organization, you also get an ArcGIS Solution item that organizes the key information products and summarizes all the ArcGIS items (applications, forms, projects, maps, feature layers, feature layer views, and so on) included with the solution. The ArcGIS Solution item also illustrates any dependencies items have on each other.